Blog Posts

As Tesla Breaks Faith With Its Believers, It's Time To Go Short

Summary

I think Tesla just made the biggest strategic mistake of its existence.

Tesla, a faith-based investment, broke faith with its believers.

What does it mean? It means I’m finally ready to stop wagging my finger at you about shorting Tesla.

Before you go short, though, make sure you’re on board with my thesis. I've summarized it here.

And, by all means, please review my cautions. Assume your cash will end just as all Tesla's cash ends: With a rapid burn.

Is it just me, or do developments at Tesla (NASDAQ:TSLA) seem to be getting weirder and weirder at some crazy, stepped exponential?

Michael Rogus put up a hilarious piece about the comical absurdity of last week’s conference call. As terrific as the Rogus piece is, and as strongly as I commend it, I also encourage you to read the entire call transcript. It would be impossible to write a parody.

For me, the time has finally come. I’m adding to my Tesla short position (via options).

Do I encourage you to do the same if you share my views about Tesla? Well, let's put it this way: I will no longer discourage you. But, first, please review the important caveats discussed in Part V.

So, what finally pushed me over the edge? I have always said Tesla is at the intersection where investing meets religion. And I think we are witnessing a big crack in the religious faith.

I. Tesla's Faithful Following

To date, Tesla has been bulletproof from ineptitude and failure as no other business enterprise of my lifetime has been bulletproof:

- It executed poorly on the Model S launch. The share price rose.

- It executed even more poorly on the Model X launch. The share price rose.

- It broke its promise about battery swapping. The share price rose.

- It broke its promises about Tesla Energy revenues and margins. The share price rose.

- It bailed out SolarCity to benefit its insiders. The share price suffered briefly, but soon recovered and rose some more.

- It made patently absurd promises about the Solar Roof product. The share price rose.

- It sold the promise of full self-driving capability, but failed to deliver. The share price rose.

- It botched the Model 3 roll-out. The share price rose.

This is only a tiny list of the many broken promises. Bill Maurer has a superb compendium, frequently updated and worthy of bookmarking.

But none of this has mattered. Not one bit.

Not the botched execution. Not the broken promises. Not the mounting debt. Not the continued dilution. Not the growing losses. Not the endless cash burn.

No, Tesla has been completely immune from the kinds of fundamentals that will make or break other publicly traded companies. And why is that?

It's because Tesla has enjoyed the unshakeable support of a core of investors, and customers, and investor/customers who believe.

They believe in the supposed genius and visionary Elon Musk. They believe in what they imagine to be the firm's world-saving mission.

The greatest marketing image in automotive history

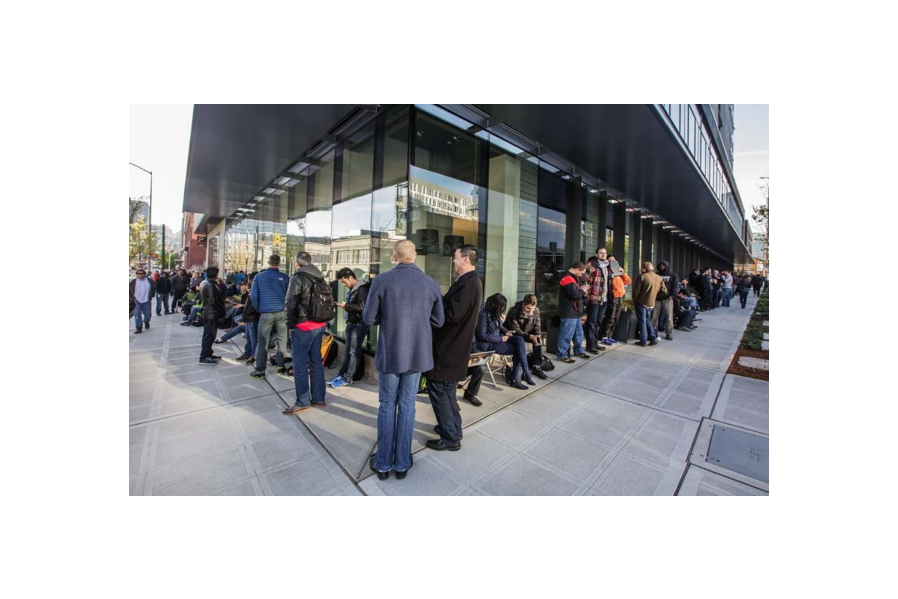

What was the greatest demonstration of that belief, creating some of the most powerful marketing images in the history of automobiles?

It was the sight, on March 31, 2016, of thousands of people lined up and camped out, at scores of locations around the world, to place their $1,000 deposits on what they believed would be Tesla's amazing mass-market car, the $35,000 Model 3.

(March 31, 2016, in Seattle. AP Photo)

Those people believed. They believed without taking a test drive, or even sitting in the car, or seeing it. They believed they would get their cars no later than 2018. Those in the U.S. also believed (or, at least, strongly hoped) the car would come with a $7,500 federal income tax credit.

And, most of all, those hundreds of thousands of people online believed this wonderful car, the one with that impressive sweeping glass roof, would cost only $35,000.

Sure, some doubts later crept in. The promise of 100,000 to 200,000 Model 3 cars in 2017 didn’t materialize. But that promise was made after the deposits were taken.

Then there was the cold bath of realization when the least expensive Model 3 one could buy would cost $46,200.

Sure, that was more discouraging, but the believers rationalized it would be temporary. They need only wait a very few more months and Tesla would be building the $35,000 versions.

Then, there was the news that the base version would have a steel rather than glass roof. And that the “premium upgrade package” included features that would be standard on any other car at that price point.

Disappointing, yes, but still they believed.

Oh, how badly we want to believe.

Because belief is such a powerful thing in our lives. We want to believe in things.

We see this even in finance. For some investors, it is not enough to view a stock as attractive or unattractive based on valuation. No, we must believe in it, and we must crush those who fail to share our belief. Submit or die, heretics!

Tesla has enjoyed an almost bottomless font of belief. It has been so loved, so trusted, by so many who have such powerful faith and such intense belief.

As David Darst, the former Chief Investment Strategist of Morgan Stanley during its glory years, once said: Markets don't change when fundamentals change, they change when beliefs change.

It appears to me the beliefs about Tesla are changing.

II. Tesla's Stunning Blunder

Late last Wednesday, Tesla notified those holding reservations for the short-range version of the Model 3 that their delivery dates were being pushed out by nine months or so. Delivery could now be expected only in late 2018. Donn Bailey wrote about it here and Anton Wahlman here.

For those would-be Tesla owners, this was terrible news. Suddenly, the danger of losing out on the full $7,500 federal income tax credit (likely to expire at the end of Q3) became very real.

Moreover, reading between the lines, and this being Tesla, they knew a nine-month delay could so very easily become a 12-month or even 15-month delay.

But this push-back in the schedule, while quite a bad thing, was not Tesla’s stunning blunder.

Rather, Tesla’s blunder was its decision not to mention the delay in its Quarterly Update letter or during the conference call. Instead, Tesla quietly updated the web pages of the reservation holders only after the conference call had ended.

Why such stealth? Probably so Elon Musk would not have to discuss the delay or answer questions about it. It would have badly undercut the happy message that Tesla was "reaffirming its guidance" of 2,500 Model 3 cars per week by the end of Q1 and 5,000 by the end of Q2.

But avoiding the topic was a gutless, cowardly move, with a huge downside.

Had Musk chosen to address the delayed delivery schedule in the Quarterly Update, and then field questions during the call, he could have spoken directly to his aspiring customers. He could have apologized for the delay. He could have assured them Tesla would do all it can to deliver.

He could have signaled by words and tone how much he cared about his faithful flock. He could have shared some pain, offered some comfort, and dispensed some hope.

Yet he did none of this. Instead, he hid behind the flashy SpaceX Falcon Heavy launch, which accomplishes absolutely nothing for Tesla investors or Tesla customers.

By taking the cowardly way out, he squandered Tesla’s most vital asset: The trust and faith of its true believers. And, suddenly, the message boards began to light up with chatter from disappointed reservation holders who were canceling their deposits.

I think MaxedOutMama nailed it with this comment:

I sympathize with (the jilted Model 3 reservation holders), especially since some of them REALLY wanted the car and spent more than just the $1k to wait for it.

My gut is that Tesla blew a whole bunch of good will away. Yes, the company has to manage tightly, but when I think of all the money that went into this company and was spent to build a very loyal cohort of customers or aspiring customers, it seems to me a tragic error. It's made all the worse because over the next year competitive products are appearing in the BEV market.

But Tesla should have tried to make its case on the investor call. They didn't even try. There's two strong negative waves reinforcing each other - one from the financials, and one from the customers.

Amen, Mama. Tesla, whose ascent has occurred in a relentless bull market, and on whom fortune has smiled at every turn, suddenly had the bad luck to have the latest delays coincide with a lesson for many investors that stock prices can, in fact, go down as well as up, and that some investments are nothing more than fad and fashion.

Do you want some evidence of this loss of faith? Here is one of Tesla's biggest and most vocal fans discussing what happened:

Has Tesla now lost all of this great stock of trust and faith? Of course not - much of it no doubt remains, perhaps even most of it. But a significant portion bled away last week, and Tesla is unlikely ever to get it back.

(Spotted in NYC by a friend - remind me who you were!)

III. I Am Adding to My Short Position

I have repeatedly warned that Tesla's stratospheric share price is completely unmoored from its dreadful fundamentals, and inveighed against shorting it.

But at some point, an investor must make hard choices. And, this being a financial investing site, a writer here must make hard choices, too.

I think beliefs about Tesla are finally changing. The fundamentals are going to start mattering.

So, I'm taking down the red flag. If you want to wade into the water, swim with sharks, and short Tesla, I'm not going to blow the whistle. I'm adding to my own short position.

IV. My Tesla Short Thesis in Summary Form

Here are some of the principal points in my Tesla short thesis. In laying them out, I am not trying to convince you. I don't even wish to debate with you.

I am doing this simply as a check list. If you find yourself shaking your head in disagreement more than two or three times as you go through this list, then a Tesla short position is likely not the right move for you.

1. Hubris

Elon Musk’s immense self-regard has led him to believe his company can do things differently from the way other automakers do them. He has special insights and visions that afford him the luxury of shortcuts.

But what seems to him a special vision and understanding seems to me a prodigious arrogance and ignorance. I encourage you to read last week's interchange between Barclays Capital's Brian Johnson and Musk. Which of the two understands automobile manufacturing, and which is the Great Pretender?

In his research report issued after the call, Mr. Johnson said management’s answers to his questions "support our view that manufacturing will remain a slow and painful ramp."

Those answers support many more conclusions than that. Conclusions about Musk's self-deluded nature that are decidedly painful.

2. Valuation

As Bill Cunningham says, it's all about valuation. Go ahead and imagine the wildest Tesla bull case at the very edge of plausibility. Now, calculate what Tesla's EPS is in that case. Did you come close to justifying Tesla's present market cap? No, you did not.

3. The Valley of Death

Subsidies have been Tesla's lifeblood. Transferable tax credits, tax abatements, free land, cheap electricity, ZEV credits, GHG credits, CAFE credits, HOV stickers, state tax rebates, and on and on.

By far the most important subsidy has been the $7,500 U.S. federal tax credit. If the Tesla buyer could not make use of it, then the leasing company could.

But for Tesla, the end is near. That credit will be slashed in half in Q4, and will disappear altogether in 2019. Meanwhile, Tesla's competitors will have lots more running room.

It is the Valley of Death.

4. Batteries Still Cost Far Too Much

Battery costs are still far too high to make EVs cost-competitive with ICE vehicles. The rush to EVs is occurring only because of government subsidies and mandates. If those policies were to change, the EV market would stagnate or shrink.

Even with existing policies forcing automakers to making EVs, none of them can make money doing so. But while most automakers have their profitable ICE vehicle lines to sustain them, Tesla has... what? Solar Roof Tiles?

5. The Model S and X Growth Stories Are Over

The Model S is a gorgeous car, and both the Models S and X were true engineering achievements, for all the criticisms one might have about their reliability.

But, even while owning the EV luxury market, Tesla always lost money making those cars, and will now lose even more as demand continues to soften. After delivering more than 100k of the Models S and X in 2017, I doubt Tesla will sell even 90k in 2018, and those at lower ASPs and gross margins.

6. The Model 3 Shortcuts

Tesla took huge risks in abbreviating the production parts approval process, production line validation, and professional beta testing for the Model 3. The car already has been plagued with quality issues, and while those eventually will be corrected, it's likely more will emerge. It's a ticking time bomb.

7. Tesla Lacks the Required Logistics Infrastructure

Tesla will face massive logistical problems in delivering its Model 3 cars once its production hits 3,000 or so per week, assuming it ever gets to that level. Those logistical snarls will add to operating expenses.

The root cause of many of the logistical issues? Tesla's decision to forgo the traditional dealer network. All other automakers use such networks, so it must be a terrible idea, right? Or, at least, so goes Musk-think.

8. The Wrong Car at the Wrong Time

Is the auto market craving a small sedan? No, it is not. Sedan sales, which were half of all auto sales in 2013, have fallen to less than one-third. As Donn Bailey has written, Tesla appears to have a surprisingly low take rate on its high-end Model 3s.

Goldman Sachs also has noticed. In a note it published after last week's quarterly report, Goldman observed that conversion rates for Model 3 reservations may be lagging the historical conversion rates of Model S and Model X. "Notably, if Model 3 conversion rates are in fact weak, the company may face a demand problem on the Model 3, not just a supply problem."

9. The $35k Model 3 Is a Unicorn

You know what would quickly cure the low conversion rate on Model 3 reservations? Offering the much lower priced base version. I promise there will be much higher demand for a $35,000 Model 3 whose buyer can benefit from a $7,500 U.S. federal income tax credit.

The problem, though, is that Tesla will lose money at a horrific rate if it sells a $35,000 Model 3. Tesla knows it cannot afford to sell any Model 3 version costing less than $45,000.

For that reason, the $35,00 Model 3 is and (except in tiny quantities) will always remain a mythical creature.

10. Tesla Is Structurally Bankrupt

Even once it ramps up Model 3 production, Tesla still will be losing hundreds of millions each quarter. As CoverDrive has spelled out, the company is structurally bankrupt - which is to say it depends completely on continued capital infusions for its survival.

(The formidable doggydogworld has a less pessimistic take than that of me and CoverDrive, but still can’t make the numbers pencil out.)

11. Insurance Costs

Tesla cars cost more to insure than other cars, and those costs have been rising. As Tesla is forced to allow third parties to handle Model 3 collision repairs, it's likely those costs will rise higher still. An extra monthly $100, or even $50, matters to a lot of buyers.

12. No Country for Auto Manufacturers

Tesla acquired the Fremont factory virtually for almost nothing, but there is no free lunch. For several reasons (high cost of labor, high taxes, high cost of living, intensive regulation), California is an especially challenging location for an automobile manufacturer.

13. Semi Silliness

The Tesla semi is a chimera. As is the Tesla pickup truck. Both would require billions in capital to develop (capital Tesla lacks), and there's no reason to believe, at the end of that trail, either could generate material profit. Donn Bailey has explained why, repeatedly and in detail - if you need a refresher, be sure to follow him.

14. The Nevada Mistake

The Gigafactory, far from being a strategic advantage, has chained Tesla to a type of battery cell (cylindrical) that other EV makers disfavor.

Worse, Tesla has no easy way out, as it must repay all of Panasonic's equipment investment plus a handsome ROI. As Andreas Hopf has said, on Nevada's high chapparal, Tesla is the horse and Panasonic the rider.

15. The Solar Roof Tile Fantasy

The Solar Roof tiles, a roofing type attempted and abandoned by others, will never be more than a tiny niche product.

16. The Tesla Energy Bust

Two years ago, Elon Musk was assuring investors that Tesla Energy would by now be generating billions in revenues with sumptuous margins.

Only the credulous could have believed this. Tesla's stationary battery products, competing with many larger firms in a commoditized market, will never generate material profits if, indeed, they ever generate profits at all.

17. The Autonomous Driving Fairy Tale

Tesla is a laggard, not a leader, in autonomous driving, and it now faces material legal liability for full self-driving promises it will be unable to fulfill.

Indeed, one of the most disgraceful episodes in the company's history was the highly misleading "Paint it Black" drive. Paint it class action.

18. China Is Not Happening for Tesla...

Lacking a local partner, Tesla is at a huge disadvantage in China, made all the worse by the new GB/T charging standard.

19. ...and Europe Is about To Be a Shrinkage Story

Tesla is now at a huge disadvantage in the European Union by reason of the CCS charging standard.

20. Competition Is Coming at the High End...

Competition is coming. It is coming hard, fast, and furious. Simon Mac has given you all the clues you need to see it will happen first in Norway with the Jaguar (NYSE:TTM) I-Pace and Audi (OTCPK:OTCPK:AUDVF) E-Tron, and then spread throughout Europe and into Asia.

In a very few months, except perhaps in California, Tesla will no longer be the aspirational EV brand.

(Audi e-tron Sportback concept - photo courtesy of Audi)

21. ...and at the Low End

The competition won’t only be at the high end. Besides GM’s (NYSE:GM) Chevy Bolt and Nissan’s (OTCPK:OTCPK:NSANY) improved Leaf, 2018 will see the introduction of EV crossovers from Kia (OTC:OTCPK:KIMTF) (the Niro) and Hyundai (OTC:OTCPK:HYMTF) (the Kona). The trickle becomes a flood in 2019 and 2020.

22. Inadequate Reserves

Tesla has experienced large warranty costs and its warranty reserves (adjusted several times in the past) may well be too small. Similarly, it's likely Tesla has not deferred enough income to cover the true cost of Supercharging. Those are but two of several ticking time bombs in the Tesla financials.

23. The Model Y: Too Little, Too Late

The time is surely right for an EV crossover, but that time is now, not three years from now, when the Model Y would arrive (if ever it does arrive) into a field already crowded with capable competitors.

That said, it is already clear the Model Y will be Tesla's Next Great Narrative. You will begin hearing lots more from Musk about the Model Y as this year progresses. It will be the ultimate car for drivers, the first true product of Tesla's machine that makes the machine. And, for investors, it will be Valhalla.

Alas, by the time of the Model Y, the FIT credit will be long gone. The EV crossover competition will be entrenched. And the Model 3 experience will have soured millennial enthusiasm for placing deposits years in advance of production (thereby depriving Tesla of a cheap source of capital).

When they listen to Musk preach the homily about the coming savior, the Model Y, will the faithful (or, at least, enough of them) still believe?

My guess is no. That's why last week's decision to sneak in the news of the big delay after the conference call was so destructive.

But, that's just my guess. Me, so weighed down, as we all are, with my heavy load of cognitive biases. I have been wrong before and certainly will be wrong again. If there's one thing that might keep the faith alive, it is the Model Y narrative.

V. The Caveats

Here are some warnings and guidelines. If you can’t internalize the warnings and abide by the guidelines, then I would discourage you from shorting Tesla. The anxiety and heartache simply won’t be worth it.

First and foremost, shorting Tesla is a gamble. Don’t gamble more than you can afford to lose. The best way to restrain yourself is to assume you will lose your entire investment. If losing it would affect your happiness, lifestyle, or ability to sleep at night, then don’t do it.

How Much Pain Can You Stand?

Elon Musk will pull more rabbits out of his hat. There will be new narratives. There will be more bullish analyst reports, and more glowing press coverage. Tesla’s share price almost surely will have more upward spikes.

Did you read that carefully? Here’s what will happen. You will short the stock in whatever fashion. And the stock price will immediately rise. Maybe by a lot. (Or, even worse, the price will immediately drop, and you'll think it was other than dumb luck, and become too confident, and oversize your short position.)

Are you ready for that? How much pain can you stand? And for how long?

Do you have the strength of your convictions? Have you done your homework? Have you read and considered, with care, the bullish views of Ron Baron, or Ben Kallo, or Adam Jonas, or Victor Dergunov, or ValueAnalyst, or Trent Eady?

How Will You Structure Your Short?

OK, if you’re still here, the next question is how you are you going to structure your short position.

Me? I keep it simple by buying puts. I want the longest possible expiration dates (January 17, 2020, right now for those publicly traded). It’s much more expensive that way, but, as I always say, time is the only reliable solvent of idiocy.

I like to spread out the strike prices. Sure, puts at the lower strikes cost less, but the greatest profit potential is from the higher strikes. So, mix it up a bit.

Are you an experienced option trader? Do you understand covered calls, call and put spreads, collars, straddles, and strangles? Do you understand implied volatility and time decay?

Please, don’t dive into options trading unless and until you are comfortable and conversant with these concepts, and until you have done some practice paper-trading for a while. Even then, consider engaging an experienced options trader to help you. Or, read David Pinsen at Seeking Alpha.

Do you want to short shares of TSLA instead? Fine, but be sure you have carefully conceived hedging and exit strategies. You know what’s definitely not fun? Margin calls. Forced selling. Unlimited exposure to rapid market moves.

Before you short the stock, make sure you have a reliable parachute, and decide in advance what will cause you to pull the ripcord.

Kiss the Cash Goodbye

Need I say it again? Tesla is not an investment. It’s a gamble. Unless you are exceptionally wealthy or a hedge fund manager who has made full disclosure to sophisticated limited partners, a Tesla short should be only a tiny part of your portfolio. I suggest 5% or less.

Some commenters here have made the case (and I think it’s compelling) that in the frothy equity markets we have seen, a Tesla short (in whatever fashion) makes for an intelligent market hedge.

Perhaps so. That's how I view my TSLA options. If you go that route, consider diversifying your short portfolio with a few other stocks. Perhaps, for instance, Netflix (NASDAQ:NFLX) or Snap (NASDAQ:SNAP) are worthy of consideration.

Obviously, though, make sure you have an equity portfolio to hedge, and size the short appropriately, and take steps in advance to limit your losses.

Finally, as I always say, the only thing more dangerous than shorting Tesla is going long Tesla. I think that’s more true now than ever.